Launching and managing tokenized real-world asset projects requires legal clarity, technical reliability, and structured investor relations.

Before building the platform, the team behind Greenpact went through this process themselves. Projects were structured and funded without a dedicated system, relying on a mix of custom processes, manual coordination, and disconnected tools for fundraising, investor communication, reporting, and compliance.

While this approach worked, it proved inefficient and difficult to scale. Each new project required rebuilding the same workflows, increasing operational complexity and administrative risk over time.

Greenpact was created to address this problem. The platform brings tokenization, compliant fundraising, and investor relations into a single, structured infrastructure designed for real-world use. What began as an internal solution is now used to support external projects facing the same challenges.

Why Greenpact exists

From setup

to long-term operations

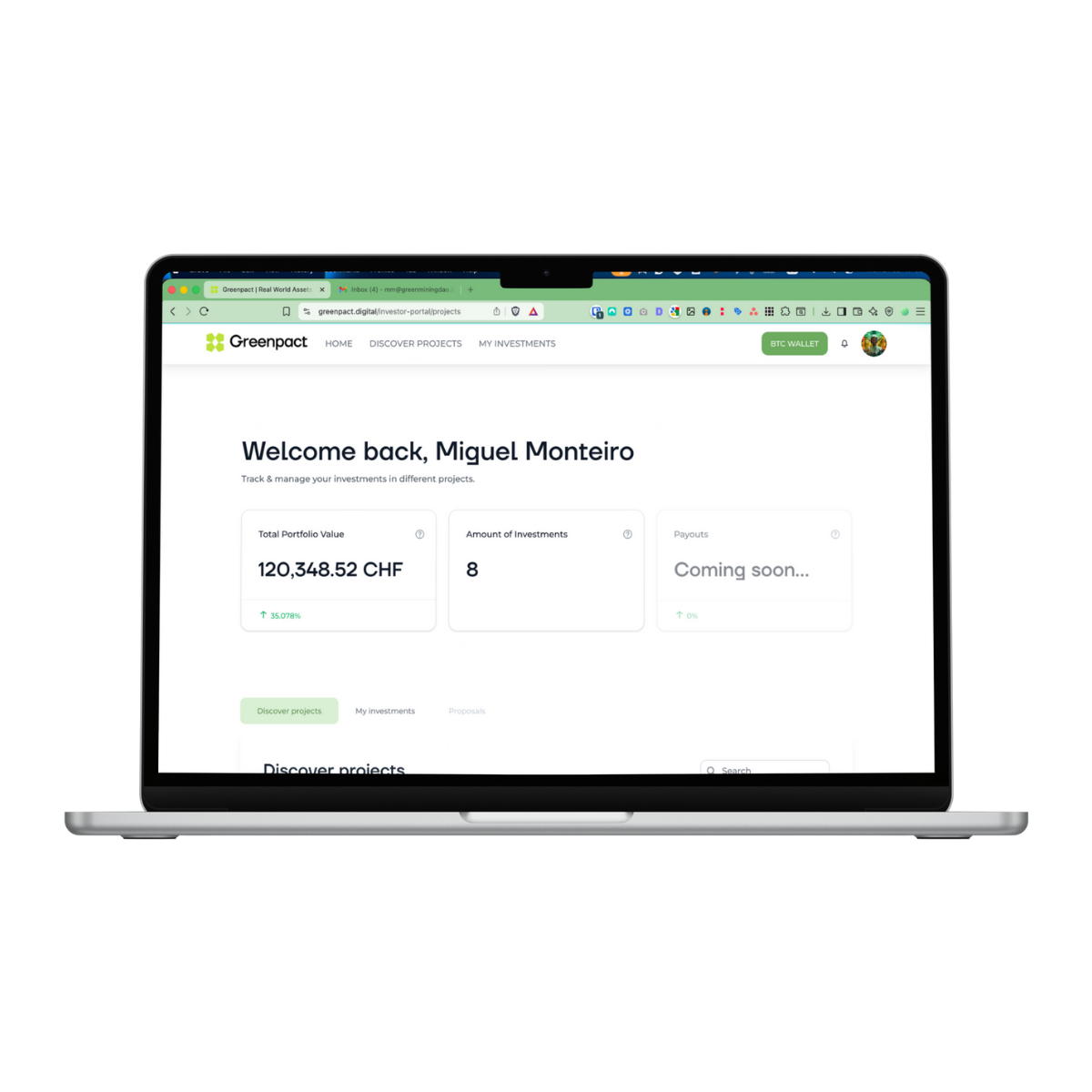

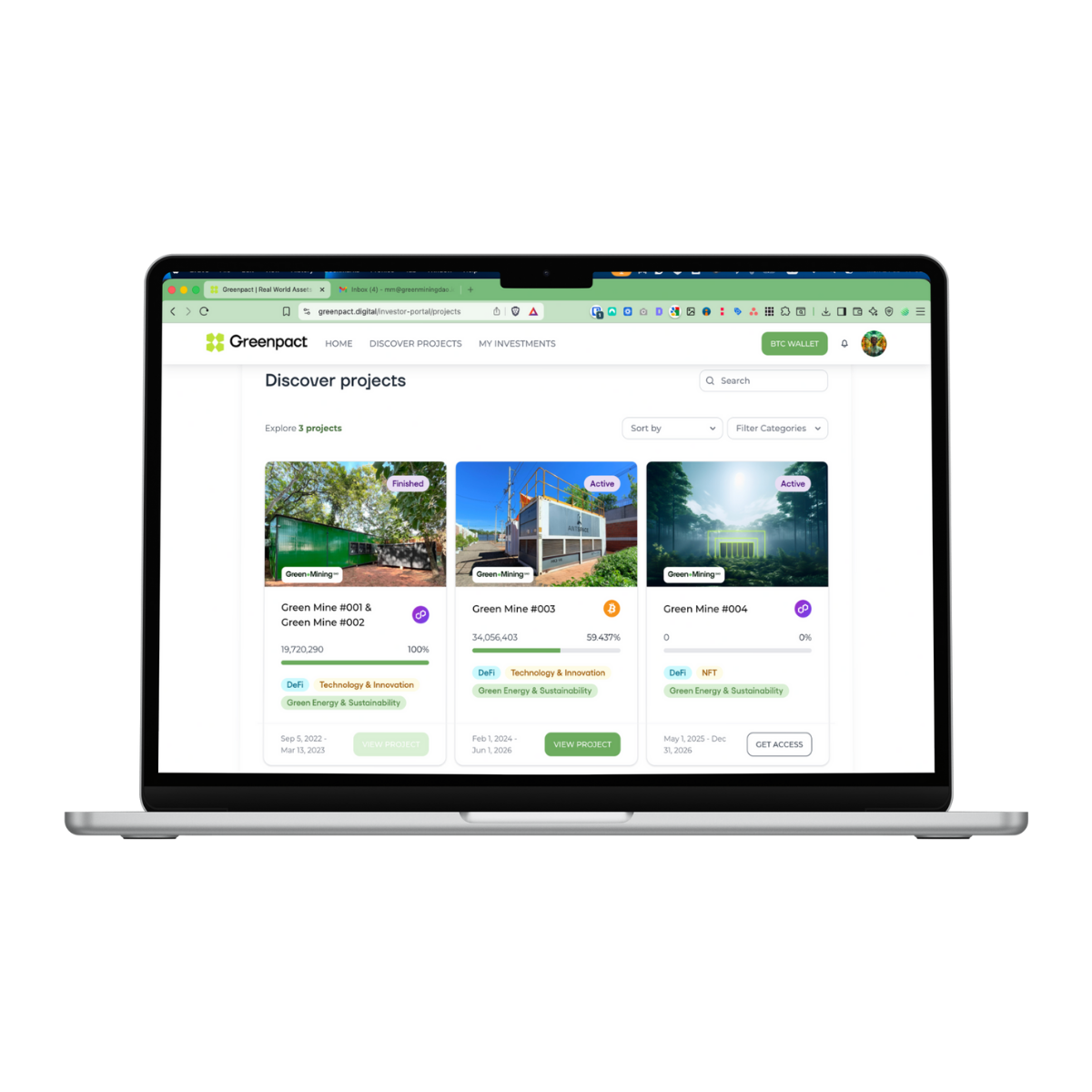

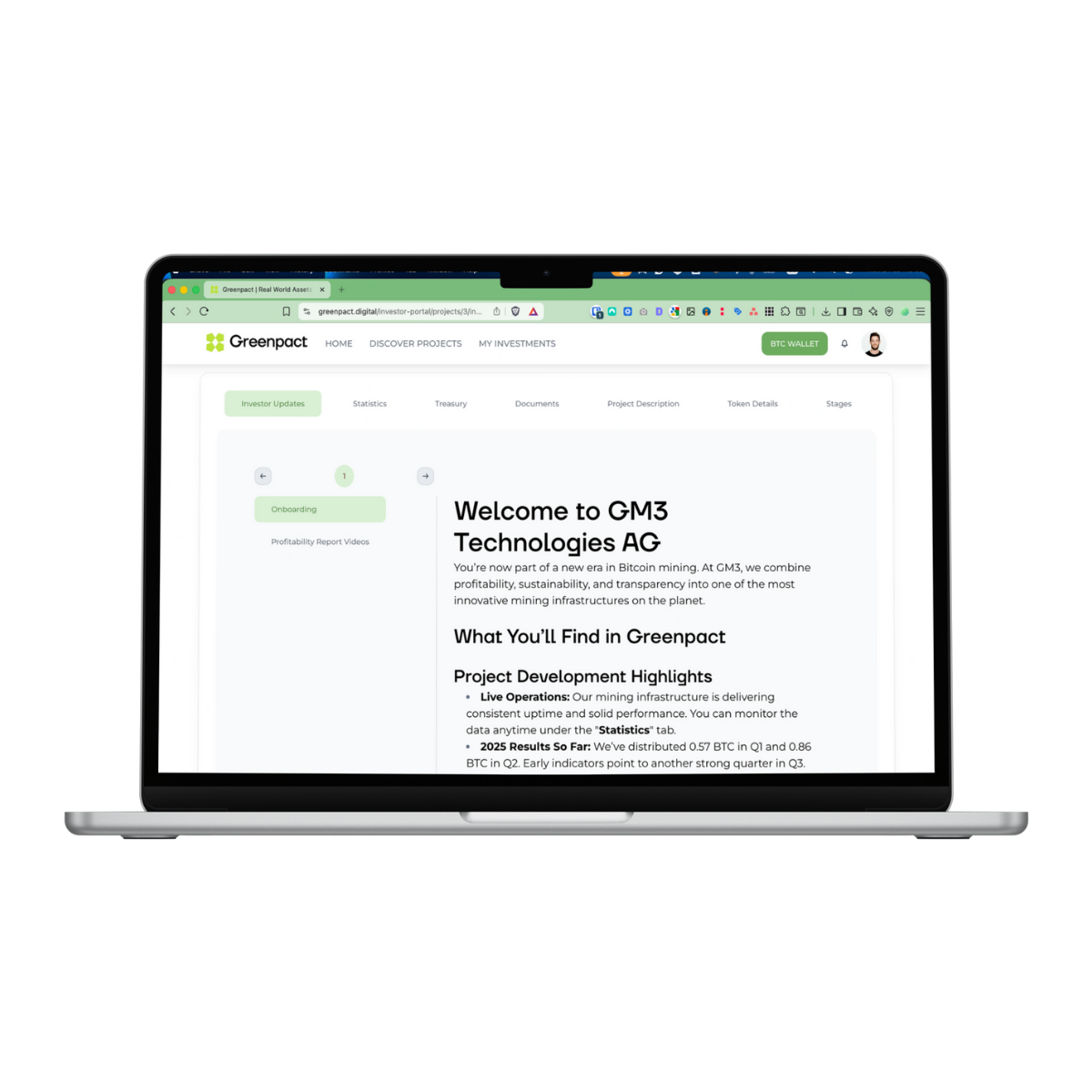

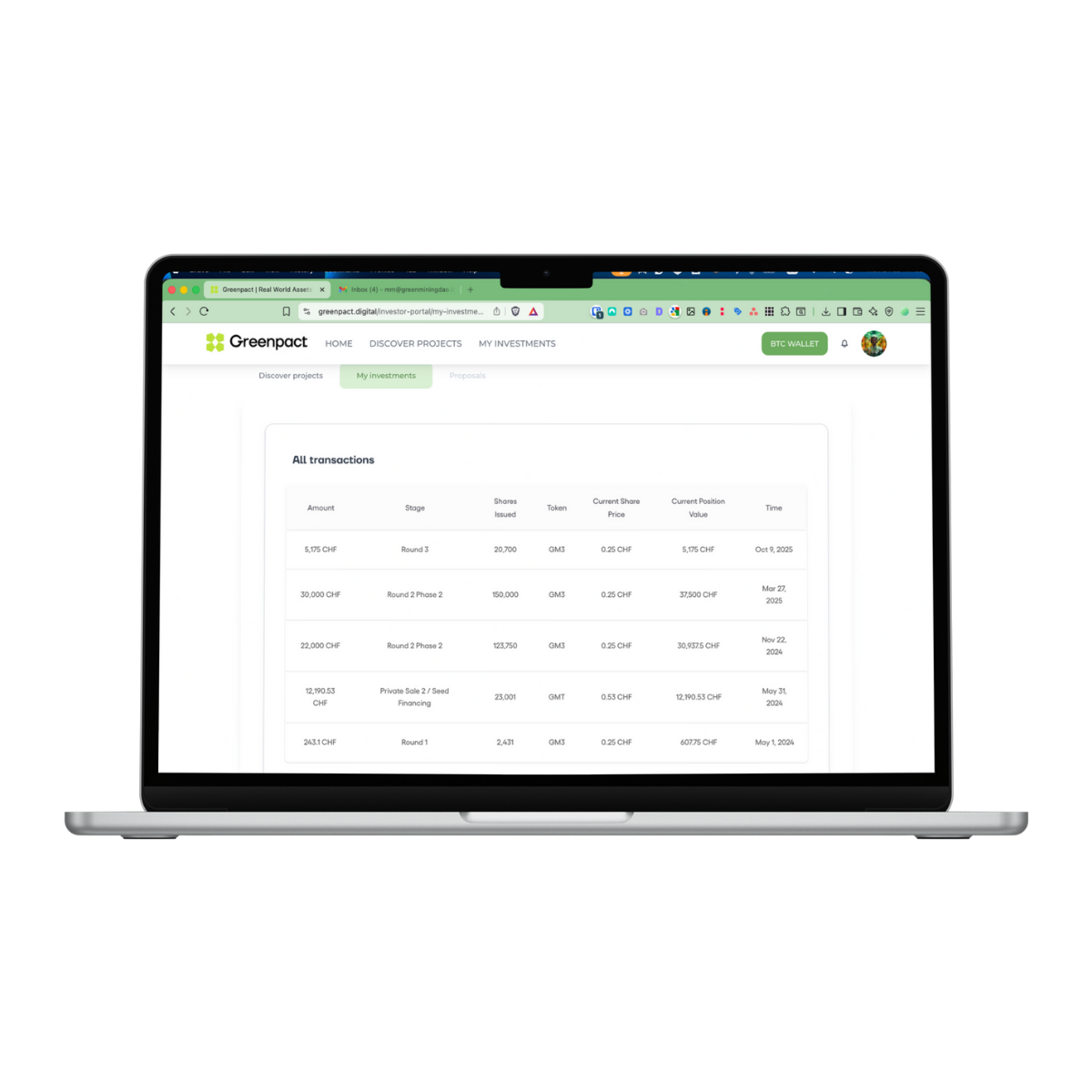

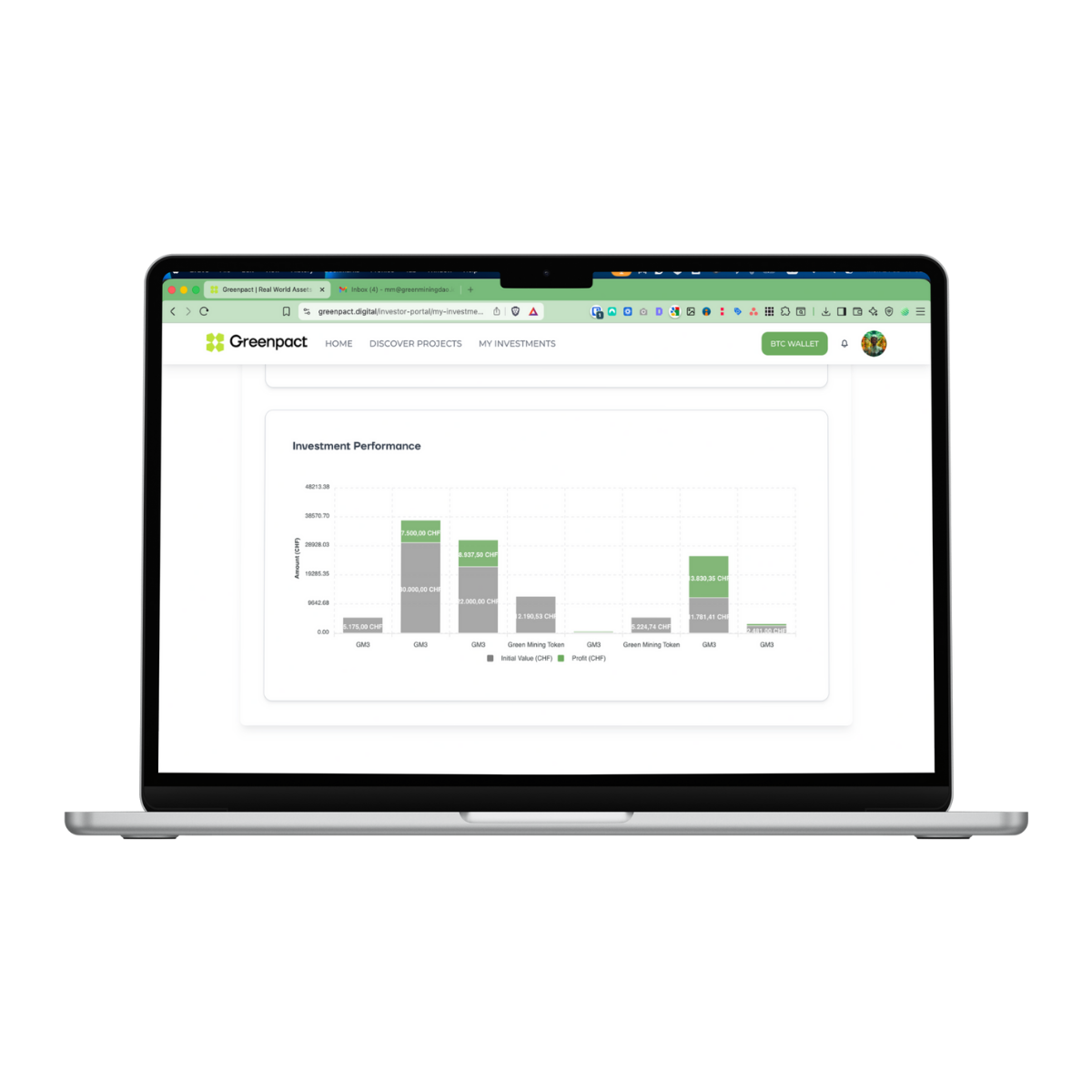

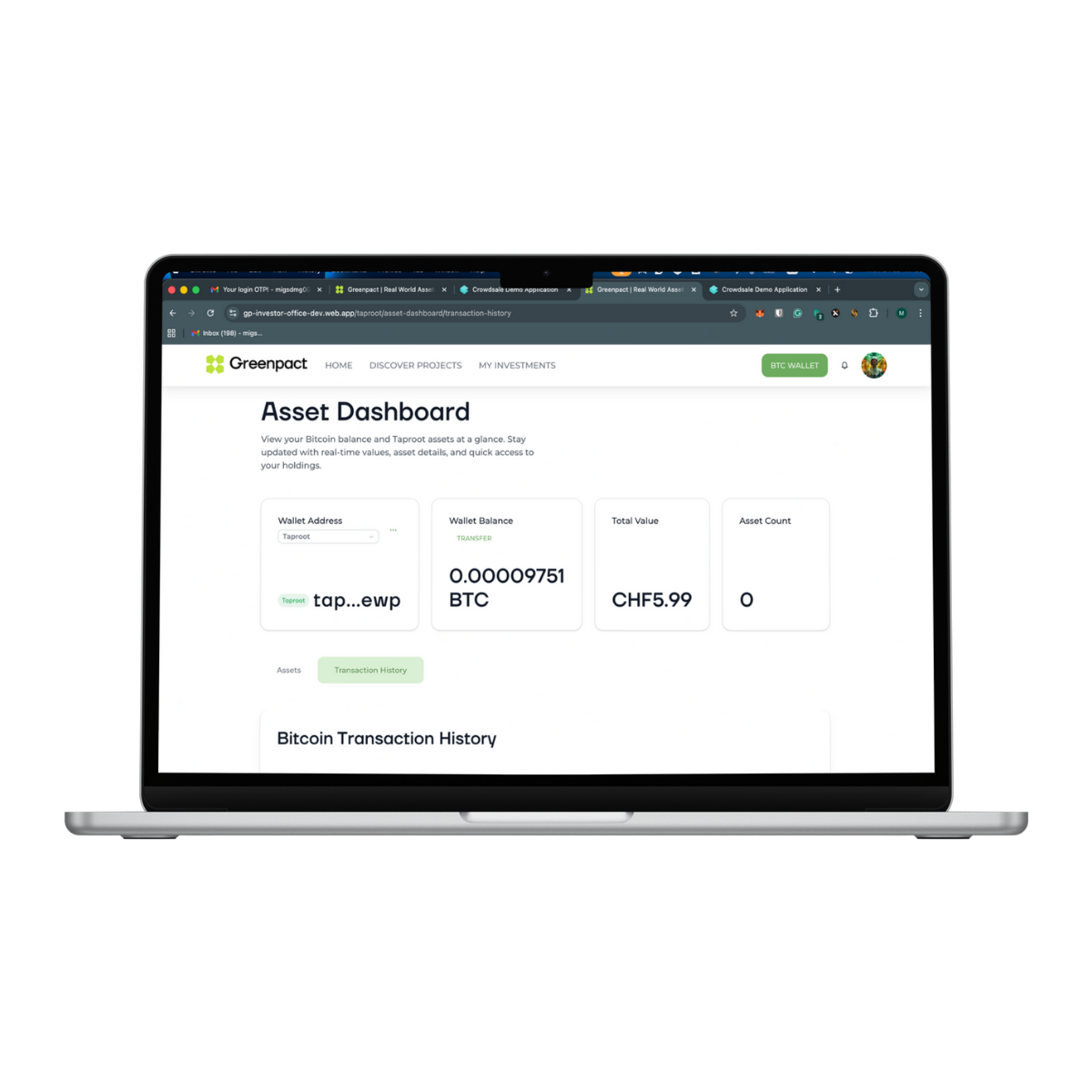

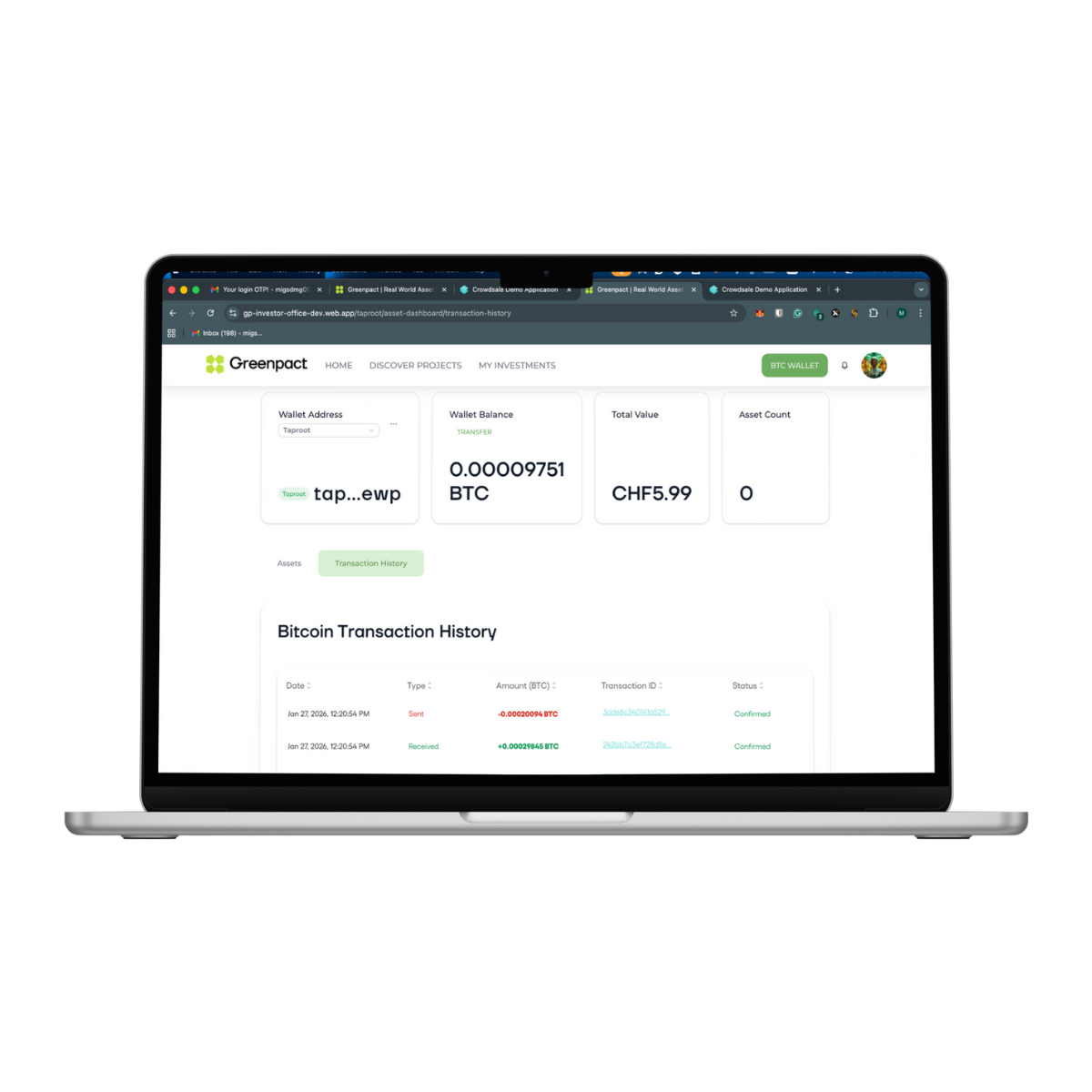

The platform supports the full lifecycle of a project, including asset tokenization, compliant fundraising, investor onboarding, ongoing reporting, and communication.

Instead of relying on fragmented tools and manual processes, everything is handled within one integrated system.

Built for regulated environments

The system is designed with compliance as a foundation, not an afterthought.

The platform currently operates within Swiss regulatory frameworks, with EU compatibility in progress, and supports legally sound tokenization and investor management workflows.

Running in live systems

Greenpact is not a concept or pilot platform.

It is currently used by two customers across live projects, with approximately CHF 3 million raised to date.

The platform is actively used by project operators and investors for day-to-day activities, including onboarding, reporting, and investor communications.

Applicable across multiple asset types

The platform is suited for sustainable real-world asset projects such as energy infrastructure, resource-backed businesses, and other capital-intensive ventures that require transparent ownership and professional investor relations.

Contact us

If you would like to learn more about the platform or discuss a potential use case, please get in touch using this form.